Brouillon créé le 29 March 2023 à 15h16

10 January 2023

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info

Global Systemic Risks

Global Systemic RisksOur modern industrial societies are characterized by the very high degree of interconnection linking the different sectors that make them up. The intersecting dynamics of these sectors, as well as the consequences of our human activities in terms of environmental destruction, are the bearers of intrinsic destabilization risks, called systemic risks. They are rooted in all the existing feedbacks between the socio-environmental components of this global system, and represent serious threats, growing with the increase of the complexity of our societies, and which can go as far as the collapse of all or part of our socio-ecosystems.

The issue of systemic risks is important in the framework of the STEEP team’s project, the core of which concerns sustainability issues at different spatial scales. The capacity of territories, civil society, States, the international community and the private sector to deal with this type of risk is one of the central elements conditioning this sustainability.

In practice, we can distinguish two major families of systemic risks according to the processes involved. On the one hand, there are long-term trend risks (decades) and short-term systemic contagion risks (months or years), which are more random in nature than the previous ones.

This type of risk is essentially due to the growing tension between our use of resources, our production of varied and often diffuse pollution, and the capacity of our (semi-natural) environment to absorb the associated impacts, as well as to the consequences of induced environmental changes on society itself. These risks are both amplified and underpinned by specific socio-political, economic and historical dynamics. The main risk is that of a partial or total collapse of planetary biocapacity, and its consequences on the human population.

This issue has widely emerged in the international public debate following the publication of the famous Limits to Growth report in 1972. The latest version of this report (Limits to Growth: the 30-year update), was recently translated into French under the same title (Les limites de la croissance). Recently, in France, this work is one of those that has most fueled the discourse on “collapsology” and the ensuing debate.

The most important point highlighted by this type of model concerns the dominant role of the feedback loops taken into account in the modeling. It is these loops, more than the more or less fine level of description adopted in the description of the different interacting subsystems, that define and control its dynamics and the associated risks of collapse.

The Limits to Growth report is based on a relatively sophisticated dynamic model, World. From the researcher’s point of view, the question posed by this model and, more generally, by all global integrated models of the same type, is to determine to what extent their conclusions (often qualitative but sometimes semi-quantitative) are robust. The ambition of our work is to provide scientifically founded answers to this question, beyond the expert or non-expert opinions expressed on the issue, and independently of the debate raised and fuelled by collapsology.

These are shorter term (months to years) but intermittent and random. This type of risk is linked to the very high level of global interconnections between numerous sectors of human activity, to the intrinsic instabilities generated by these interconnections, and to their possible propagation by domino effect in all sectors of society. These risks are intensified by the current geopolitical dynamics, and by the aggravation of environmental problems.

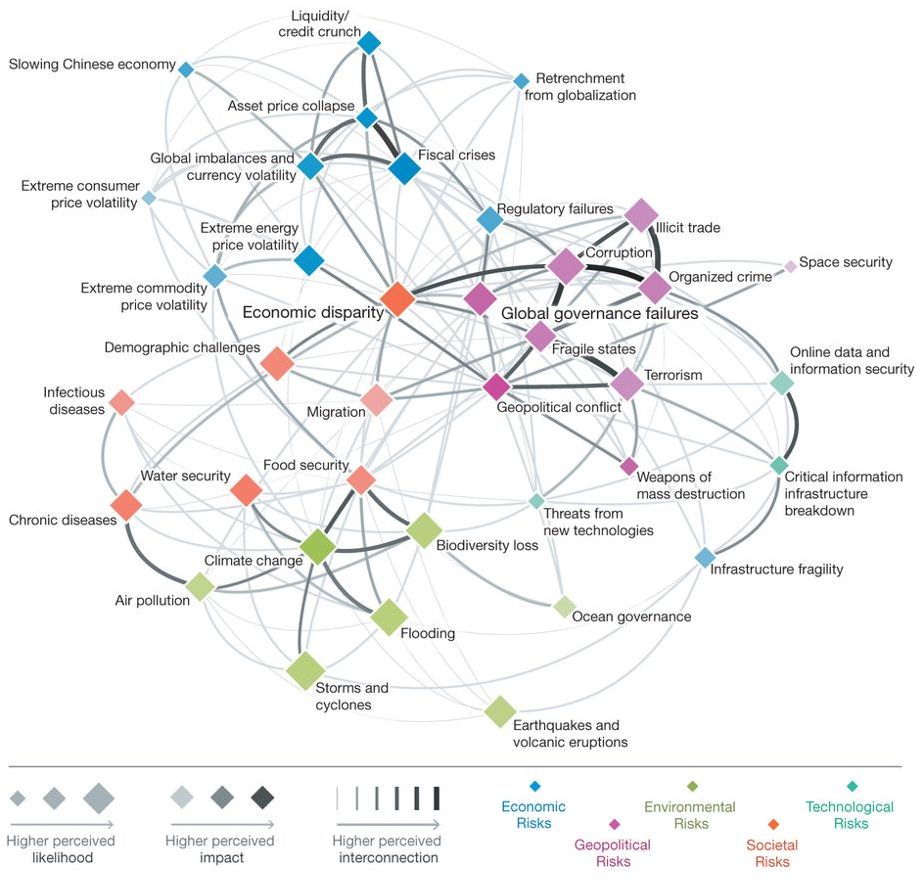

In such a context, the systemic risks linked to the propagation of various shocks across different sectors of activity are therefore real and largely underestimated. The term “systemic contagion” used to designate this type of process refers to the propagation of a crisis to the whole of our interconnected economies and whose origin would be in a specific sector. If crises of this type become sufficiently numerous and/or significant, a risk of collapse may eventually result, if each of them produces an inability of the system to return to its initial state. This type of collapse would thus be characterized rather by a series of successive cumulative steps than by a single major disruptive event, or a slow but continuous degradation. The graph below provides an integrated view of the major categories of this type of risk and their interactions.

The possible triggers are of various kinds. One of the most frequently mentioned is a new financial crisis, which, given the increased fragility of States and the global banking and financial system, would very likely be much more difficult to control than the previous one, especially since the recessionary effects of the latter have not yet been completely erased. The worldwide health crisis linked to COVID-19 is almost a textbook case of this type of risk, and of their capacity to spread to all sectors at the global level, as well as of the short- and long-term consequences (the bulk of the latter still to come).

Fore more information, read the research program.

10 January 2023

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info26 November 2019

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info