Research Program

Research Program

Long Term Trend Risks

The report on the limits to growth is based on an emblematic and even unique model, the World3 model. Both the model and the conclusions drawn from it have long been highly criticized, particularly by several currents of economic thought, but the situation changed at the turn of the millennium.

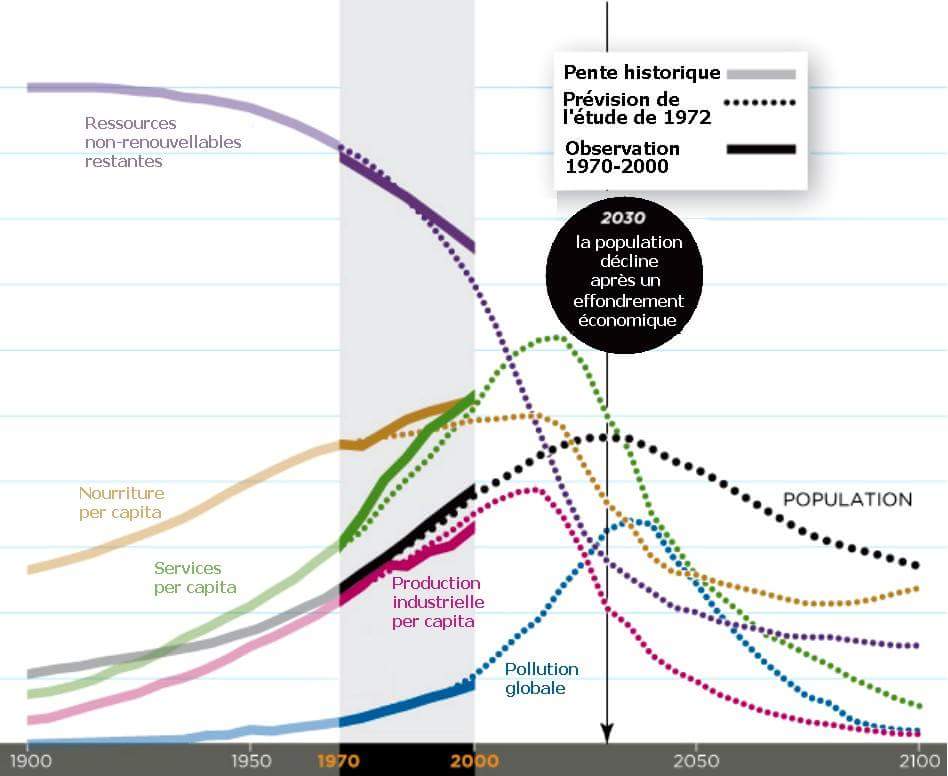

Opposite: the projections of the standard World3 scenario compared to 40 years of historical hindsight (Graph: R. Stevens & P. Servigne)

Dots: projections (Meadows, Randers & Meadows, 1972, The Limits to Growth, Universe Books, New York)

Bold and shaded areas: historical data, and comparison with standard scenario projections (Turner, 2008, Global Environmental Change, 18, 397-411)

The curves before 1973 represent the calibration of the model on the real history

The debate has shifted nowadays, and the graph above summarizes two dominant views on the relevance of the World3 model:

- On the one hand, part of the economist community now believes that because of the agreement between the model’s standard scenario projection and “reality” (choice of representative global variables), the model actually says something relevant about the evolution of our global socio-ecosystem, and the associated risks of collapse

- On the other hand, a part of the environmental and hard science community points out that for the moment, the model is not really tested.

The work undertaken in the STEEP team aims to analyze the validity and robustness of this model, in order to objectify the debate. This work has three components:

- An analysis of the choice of parameters based on a sensitivity analysis sensitivity analysis that is much more refined than the existing ones.

- An analysis of modeling choices based on a sectoral and/or geographical disaggregation of the model and/or geographical disaggregation of the model, in particular with a view to modifying the system of feedback loops (these constituting the most essential part of the model).

- Elements of epistemological analysis. In particular, it is a question of discussing what it means to validate a model of which only one historical instantiation can take place (a similar question arises in other scientific domains, for example modern Cosmology).

This issue is the subject of a thesis project, underway since 2019. A potential issue is the possibility of discerning trend collapse risks in the short term (pre-2050) or further out in time (post-2050), both of which involve different mitigation and adaptation strategies that need to be properly anticipated.

Short Term Risks of Systemic Contagion

In the current state of research, these risks remain poorly known. However, leaving aside the strictly (geo)political aspects of the question, they lend themselves relatively well to a modeling exercise, whose primary objective is not to obtain precise quantitative evaluations, but to draw a finer qualitative and semi-quantitative understanding of the issues, as existing models are either too sectoral or too generic. Limiting ourselves to the interconnections between energy, food security, logistics and finance is an ambitious but realistic objective for addressing this type of issue.

More precisely, the work envisaged on this front concerns the development of a system dynamics model of this type of systemic risk. The objective is multiple:

- Identify the most important feedback loops of the coupled energy/agro-food/logistics/finance system.

- Identify the most fragile links in the supply chain.

- Assess the likelihood of this type of risk, and, if necessary, define mitigation strategies.

The focus on energy and agri-food commodity supply chains is due to the central (and underestimated in the second case) role they play in our Western societies. This work could be carried out in several steps: sectoral analyses in collaboration with different experts, modeling and testing by sectoral blocks (e.g. logistics/finance, energy/finance) before integration into an overall model, calibration (on public data for this project) and scenario study.

This work is the subject of a thesis that started within the STEEP team in 2019. The first phase focused on a reanalysis of hydrocarbon resource issues, with a focus on energy return on investment (EROI) issues.