Brouillon créé le 29 March 2023 à 15h16

10 January 2023

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info

Modern societies are characterized by a very high level of global interconnections between many sectors of economic activity. These generalized interconnections carry intrinsic risks of instability, known as systemic.

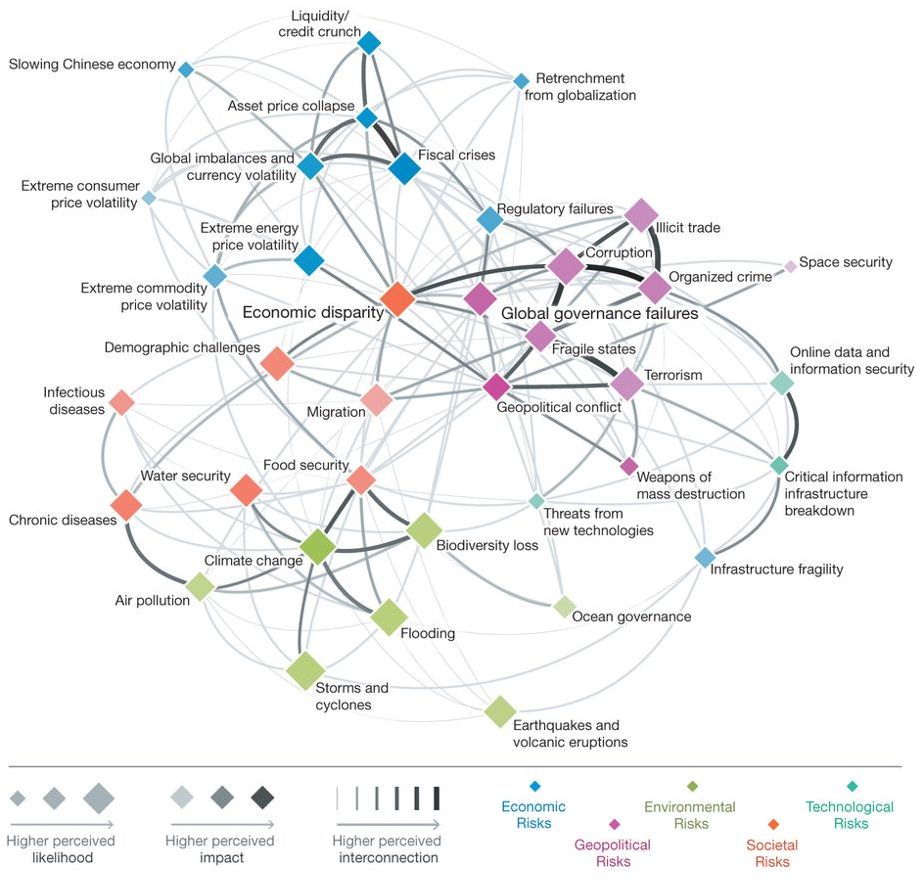

The interconnections mentioned are quite complex. The World Economic Forum annually produces a document assessing the perception of these risks based on expert opinion; these interconnections are shown graphically in Fig. 1, as described for the year 2011.

Five main categories of risk can be identified: economic, geopolitical, environmental, social and technological. In the economic sector, the main risks are related to market instabilities, particularly in the energy sector, as well as financial risks. Geopolitical risks largely relate to potential sources of conflict. On the environmental front, climate change, biodiversity loss and their consequences appear to be dominant. On the societal front, issues of inequality, food security, access to water and health are prominent. As for technological risks, they relate to the fragility of modern computerized communication systems and infrastructures (e.g. electricity distribution networks). Many of these risks are directly related to global changes, the magnitude, pace and acceleration of which have been unprecedented in the last fifty years (Steffen et al., 2015). Unsurprisingly, a significant part of the interconnections between these risks reflect the linkages between the different sectors of global global change.

In this diagram, three "nexuses" are identified. The water-food-energy nexus is particularly important since it is the most cross-cutting, linking the most important social, economic and environmental risks. In fact, there is a risk of disruption of our energy and raw material supply structures, particularly of agricultural origin, due to the great interconnection of the different sectors of our globalized society, to the large number of socio-technical and institutional interlocks and their interactions, and to the fragility of agricultural production systems in the face of climate change, particularly extreme events.

In such a context, the systemic risks linked to the propagation of various shocks across different sectors of activity are therefore real and largely underestimated. The term "systemic contagion" used to designate this type of process refers to the propagation of a shock to all of our interconnected economies, the origin of which would be located in a specific sector. If crises of this type become sufficiently numerous and/or significant, a risk of collapse may eventually result, if each of them produces an inability of the system to return to a state similar to its previous state.

Each of these crises can be expected to occur on fairly short time scales (a few weeks to a few months), but their triggering condition is a priori random. This characteristic distinguishes this type of process from the global disruption mechanisms at the Limits to Growth that have resurfaced in public debate and in the academic world in recent years, linked for example to pressures on resources or the environment, and which are part of much longer-term (a few decades) trend dynamics.

The possible triggering factors are of various orders. One of the most frequently mentioned is a new financial crisis, which, given the increased fragility of states and the global banking and financial system, would very likely be much more difficult to control than the previous one, especially since the recessive effects of the latter are still not completely erased; another potential factor, less frequently evoked but also of non-negligible probability, would be a generalized blackout of the electricity distribution system on a larger scale (for example, all of Europe instead of part of a Member State) and over a longer period (several days instead of a few hours) than previous episodes of the same type.

Conversely, some resilience characteristics of existing supply chains should not be underestimated in this kind of analysis either. To cite another, perhaps more telling example, it is well known in the specialized literature that the modern global just-in-time logistics strategy is prone to potentially disruptive instabilities and therefore carries a significant intrinsic systemic risk, especially in the current context of increasing strain on resources.

The literature on systemic risks is extensive (see for example Helbing 2013 and Centeno et al. 2015), but for the time being, specific modeling attempts for these risks and the associated disruption issues are quite limited, and often sector-specific.

It can therefore be said that in the current state of knowledge, these risks remain poorly known. However, leaving aside the strictly (geo)political aspects of the issue, they lend themselves relatively well to a modelling exercise, the primary objective of which is not to obtain precise quantitative assessments, but to draw a more refined qualitative and semi-quantitative understanding of the issues, as the existing models are either too sectoral or too generic. Limiting itself to the interconnections between energy, food security, logistics and finance is an ambitious but realistic objective for addressing this kind of issue. More specifically, the work envisaged on this front involves the development of a systems dynamics model for this type of systemic risk. The objective is multiple:

The focus on agri-food energy and raw material supply chains is due to the central (and underestimated in the second case) role they play in our Western societies. This work is carried out in several stages: sectoral analyses in collaboration with various experts, modelling and testing by sectoral blocks before integration into an overall model, calibration (using public data for this project) and scenario studies.

10 January 2023

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info26 November 2019

(Français) La notion de sobriété renvoie à une distinction implicite entre désirs et besoins, la distinction entre...

More info